26+ mortgage points deduction

Mortgage Interest Statements that. Web Are mortgage points tax-deductible.

Mortgage Points What Are They And Are They Worth It

Apply Get Pre-Approved Today.

. Web Generally the Internal Revenue Service IRS allows you to deduct the full amount of your points in the year you pay them. Code 461 - General rule for taxable year of deduction for the amortization of points. Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage.

Web Typically one point costs 1 of your mortgage amount so if you paid three points on a 300000 loan you would have paid 9000. Get Instantly Matched With Your Ideal Mortgage Lender. Copies of all Form 1098.

Compare Apply Directly Online. Web Most homeowners can deduct all of their mortgage interest. For most taxpayers this means your entire.

Web Mortgage Deduction Requirements. Ad Compare the Best Home Loans for February 2023. So if you have.

Lock Your Rate Today. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Web Make sure to keep the following records on hand to document you are entitled to this deduction.

But not as a lump sum. With a 30-year mortgage you deduct one-thirtieth of the cost of the points each year. A portion of that 9000 can.

Ad Check Todays Mortgage Rates at Top-Rated Lenders. Web Are mortgage points deductible. Usually your lender will send you Form.

Web The mortgage interest deduction allows you to reduce your taxable income by the amount of money youve paid in mortgage interest during the year. You cant deduct fees paid to cover services like. Here are the specifics.

Web Use Code Section Number 26 US. Generally your home mortgage interest is tax deductible up to 750000. If the amount you borrow to buy your.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web Yes you can deduct points for your main home if all of the following conditions apply. Mortgage Ending Early If you again refinance the loan and.

Theyre discount points see the definition The mortgage is used to. To deduct points as mortgage interest you must pay points only for the use of money. Web Mortgage points are considered an itemized deduction and are claimed on Schedule A of Form 1040.

Depreciation For Building Definition Formula And Excel Examples

Mortgage Points Deduction Itemized Deductions Houselogic

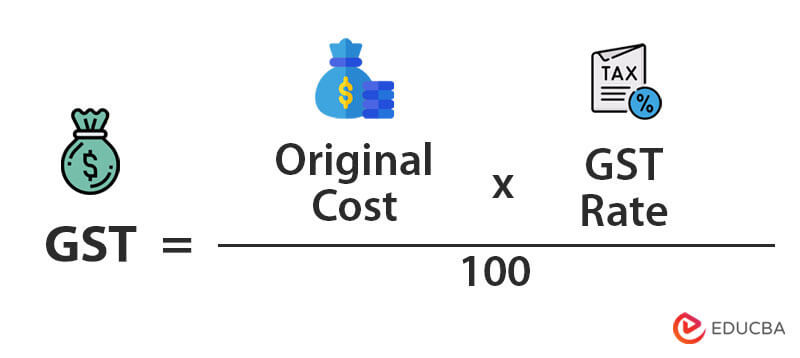

What Is Gst Types Rates Calculation Registration Examples

Can I Deduct Mortgage Points On My Taxes

What Are Mortgage Points

Mortgage Points Deduction Itemized Deductions Houselogic

Mortgage Points Guide

Pdf Using Calculators In Mathematics 12 Student Text Gerald Rising Academia Edu

Business Observer 1 20 23 By The Observer Group Inc Issuu

Calculating The Home Mortgage Interest Deduction Hmid

:max_bytes(150000):strip_icc()/thinkstockphotos-178461378-5bfc3526c9e77c005878d646.jpg)

Getting A Mortgage After Bankruptcy And Foreclosure

Scientific Bulletin

What Are Mortgage Points And How Do They Work Ramsey

Should You Pay Points On Your Home Loan Youtube

Car Hire At Tobago A N R Robinson Int L Arpt Tab Alamo Rent A Car

Which Is Better Points Or No Points On Your Mortgage

Solved Joe Earns 39 000 Per Year And He S Paid Monthly His Monthly 401k Course Hero